|

The Website

Remember that the Investment

Science web site is available. It is located at

http://www.investmentscience.com. You will find copies of

past issues of this Newsletter at the site, as well as additional

information about investment science projects and software tools.

Your comments on the site are welcome.

New

Projects

In addition to continuing work, we have carried

out some new interesting projects this year, including several

student projects done for local companies done in conjunction with

the Investment Practice course taught at Stanford by Robert

Luenberger. In addition, two students worked on a comprehensive

project for HP Labs, and we have carried out a very interesting new

area of investment science at Cadence Design Systems, Inc. The span

of application areas is increasing beyond project valuation and

management to design of pricing systems, study of business models,

development of R&D strategies, and enhancement of intellectual

property values. Sound financial theory coupled with strong

modeling and computation is a formula that has enormous

potential.

Short Course News

Short Course News Investment Science for

Industry was given at Stanford in April. We had a very good group

in attendance and very much enjoyed the interaction. The course

content continues to evolve, partly because of advances we make at

the university and partly because of the feedback and ideas that we

get from participants of the course. The course will next be given

this September 14-15. Several past participants have referred

colleagues to the course, and this has become a good mechanism for

spreading the ideas of investment science. I hope you will consider

presenting the idea of the course to your colleagues. You may refer

them to the course though the web site

http://www.stanford.edu/~luen or to the

investmentscience.com web site mentioned above.

New

Dissertation

Mark Erickson obtained his

Ph. D. in Management Science and Engineering, at Stanford

University this past June. His Dissertation is titled, "Real and

Financial Options: Theory and Lattice Techniques." This work

makes a substantial contribution to both the theory and practical

application of investment science. He presented a comprehensive

theory for valuing options that are defined in terms of observable

quantities that do not have prices. For example, one might have an

option based on the weather or on the size of the market for a

certain product. He also presented an outstanding analysis of

various lattice methods for representing uncertain processes and

showed how to construct lattices that are both computationally

efficient and technically accurate. His work is an important piece

within the investment science framework.

Price

Cycles in Competitive Capital-Intensive

Industries

By H.

Marius Holtan, Ph.D.

Overview

Severe earnings fluctuations, or cycles, coming about as a result

of large variations in the product's price, is a defining

characteristic of many industries. Prominent examples of such

industries are petrochemical, semiconductor, paper, and

construction. In fact, most if not all commodity industries

experience serious earnings fluctuations.

Capacity planning can be

difficult in a cyclical environment. In particular, while cycles

may at first glance appear to be periodic they also exhibit

strictly random behavior. This randomness, coupled with large

fluctuations, long lead times from initiating capacity construction

to final use, and large capital expenditures makes capacity

planning especially hard.

Capacity planning becomes

easier, however, if we understand the fundamental causes of

cyclicality. With this knowledge we can devise a capacity planning

strategy that takes advantage of good opportunities and minimizes

mistakes during especially difficult times. While uncertainty will

always influence the end result, a structured approach based on an

understanding of the fundamentals driving the industry should

significantly improve the odds.

Some often cited reasons for

cyclicality range from unavoidable cyclical fundamentals in the

industry to the presence of crazy eddies, i.e. irrational behavior

on either the supply or the demand side, to herd behavior, to

industry competition.

While we do not preclude the

presence of any of these reasons as a cause for industry cycles,

recent investment science research has shown that competition

stands as a significant contributor to severe industry

fluctuations. Moreover, companies that are aware of the effects of

competition and equipped with a capacity planning strategy that

incorporates competitive effects may expect to dominate their

industry in the long term.

The next section will

discuss the basis of the research. The discussion is kept at a

qualitative level. We then turn our attention to the competitive

advantage gained by using the competitive knowledge-based strategy

versus a deterministic net present value strategy.

Competition and Industry

Cycles

The main motivation of

companies is to improve profitability. In a typical commodity

industry this means cutting costs/improving production efficiencies

or increasing production. Influencing the price is generally not an

option for companies in a commodity-type industry because in such

industries the price is set by the overall market demand and

supply.

Production volume can be

changed in either of two ways: buying other companies' capacity or

constructing more capacity. To understand the effect of competition

on cyclicality we focus on capacity construction, as buying other's

capacity does not alter industry supply.

We now describe a typical

scenario of supply decisions over time according to our industry

model.

Capacity construction occurs

at some point after demand has been rising and current and future

expected industry earnings are high. At this point the return on

investment of building a new production facility is sufficiently

high to cover the capital market's requirement of expected return

relative to the level of accompanying risk. As long as demand rises

more capacity is built. At some point though, because demand is

fundamentally uncertain, demand will suddenly change direction and

start decreasing. This will cause companies to stop initiating new

construction.

The result of the above

description is that the industry will experience first a boom and

then a bust. While demand is rising but before capacity under

construction becomes available, companies experience a seller's

market. Limited supply and ample demand generates high prices and

correspondingly high earnings. When new capacity becomes available

the price level flattens or perhaps decreases slightly, but as long

as demand grows profits remain high.

The boom will come to an

abrupt end, nonetheless, when demand shifts direction. Not only

does demand decline, supply will continue to increase for some time

as construction started prior to the downturn provides new

capacity. Both effects combine to put severe downward pressure on

the price. The result is that the industry will experience a

significant decrease in earnings and losses will occur for the less

efficient suppliers.

It is important to point out

that we do not assume any irrational behavior on the part of the

suppliers. Every supplier has the same objective, which is to

maximize the market value of their company. The outlook at the

point in time when a company is making its investment decision is

positive with an expected return that satisfies the capital

market's requirement of expected return relative to the level of

accompanying risk. It is just that investing in capacity is risky

and at some point the risk will negatively affect the

industry.

With regard to phenomena

such as irrational behavior and herd mentality occurring during a

boom interval, in a well functioning capital market it is not

likely that they will persist on a large scale because such markets

are quick to punish mistakes through means such as bankruptcy,

restructuring, or takeover.

In the above scenario we

defined the time when a company would invest in new capacity as the

time when a new investment would satisfy the capital market's

requirement of return versus accompanying risk. For this statement

to be useful, except for the odd CEO with an intuitive grasp of

market value, it is necessary to have a valuation model that

incorporates the competitive element. In fact, not even the CEO

with an intuitive grasp of market value can usually provide an

exact value. In contrast, a valuation model will quantify an

opportunity and therefore numerically verify the value of a good

opportunity and the savings for avoiding a bad

opportunity.

The basic idea of the

valuation model that emerges from our competitive industry research

is as follows: Suppose there were a futures market for the

industry's product. Suppose further we sold all future output of a

new plant in the futures market. Assuming that no other

uncertainties impacts the plant's cash flows, the value of

uncertainties impacts the plant's cash flows, the value of the

plant's new cash flow would be the net present value of the

discounted futures cash flow stream net of any production costs,

using the riskfree rate as the discount rate. Thus, the futures

price for delivery at some future point in time represents the

value as seen from the point of view of the capital markets of a

delivery of a unit of production at that point in time.

The above works nicely when

a futures market is available, in which case all necessary

information for valuation is publicly available. Our research

describes a method for calculating synthetic futures prices when no

futures market exists for a particular product.

There are two other

characteristics that are worth mentioning. First is the fear of

losing out by being preempted. That is the reason there always is

some company that invests in new capacity at the very moment the

value of the investment is sufficient to meet the capital market's

requirement. Companies know that their choice is to either seize

the moment or face the distinct possibility of being preempted by

another company's investment the next day.

Second, competitive

industries often operate in a price region where customers'

sensitivity to price fluctuations is small. A small change in

demand will result in a large change in price, causing both large

upward and downward fluctuations in earnings for small demand

variations.

Competitive Advantage of a

Competitive Knowledge-Based Strategy

To compare the long term competitive advantage of

following a competitive knowledge-based strategy versus following a

strategy based on a deterministic net present value model we built

a model that simulates industry conditions over a 40 year time

horizon. The model works as follows: The industry is defined by a

supply side, consisting of a number of companies, and a demand

side. The total supply at a point in time is the sum of each

company's capacity. The demand side changes randomly at the

beginning of every month, the expected growth rate of demand being

positive. After demand has changed we derive the price of a unit of

production by equating supply over that month with demand during

the month. The earnings of a company for a particular month is

given by the product of its capacity and the price of a unit of

production reduced by the cost of producing that unit.

Each company can attempt to

increase its earnings by building more capacity. Building capacity,

however, is costly and there is a construction lag. To make

construction decisions each company relies on its own valuation

model. A valuation model can be used to value a new unit of

capacity or an existing unit of capacity. For the purposes of this

study, there are two types of valuation models and we partition the

companies into two groups according to which valuation model they

use. One group uses a deterministic net present value model. The

other group's valuation model is based on our research, which takes

into account competition and demand uncertainty when valuing

capacity.

Companies can also trade

capacity. We assume a trade occurs each time that the estimated

values of the two models differ by more than 10%. When this is the

case the group with the lower estimated value will sell 5% of its

capacity at the middle value point.

Each group's performance is

measured by repeatedly simulating industry conditions. At the end

of each run we collect for each group the overall level of

cumulative earnings and the overall level of capacity. We assume

that the group using the deterministic net present value model

initially owns 90% of the total capacity.

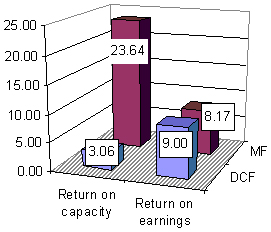

Figures 1 and 2 show the

results under two industry scenarios. In the first scenario the two

groups are not allowed to trade capacity while in the second

scenario the groups are allowed to trade. In both scenarios the

groups can build new capacity.

The columns represent

expected total return on capacity and earnings relative to initial

market share. Thus, under scenario 1 the expected capacity growth

of the group using the deterministic net present value model is

3.06 times relative to their initial capacity and expected

cumulative earnings invested at the risk free rate is 9 times their

initial market share. These results can be contrasted by the

knowledge-based strategy group where the expected capacity growth

is 23.64 times their initial capacity and expected cumulative

earnings invested at the risk free rate is 8.17 times their initial

market share.

Figure

1. Expected total returns on

capacity and earnings when no trading of capacity is allowed

between the two groups. DCF represents the supplier group using

deterministic net present value model and MF represents the

supplier group using the competitive knowledge based

strategy.

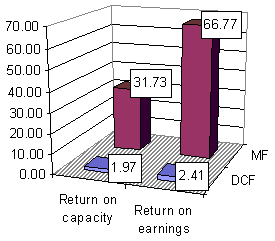

Figure 2.

Expected total returns on capacity and

earnings when trading of capacity is allowed between the two

groups. DCF represents the supplier group using deterministic net

present value model and MF represents the supplier group using the

competitive knowledge based strategy.

While the relative advantage

of using the competitive knowledge-based strategy is significant

when the two groups do not trade capacity, the performance is

especially impressive when trading is allowed. In the latter case

we expect the group following the competitive knowledge based

strategy to increase its market share from 10% to about 64% while

at the same time through timely trading capturing 76% of the

earnings generated by the industry.

Conclusion

Cycles is a phenomena that has impacted

certain industries for a long time. Our research shows that the

existence of cycles can be viewed as a natural characteristic of a

competitive economy. In this case, it is our view that behaving

optimally within a cyclical environment, managing risk and

aggressively pursuing new opportunities when they appear, will lead

to superior results compared to trying to control or influence the

cycles. The latter actions can potentially go against the natural

behavior in a competitive industry and can thus reduce the

beneficial aspects of economic competition.

The model emerging from the

cycle research also provides a collection of synthetic futures

prices. These futures prices can be used to calculate the value of

an existing plant and also on a potential investment in new

capacity. This valuation model can be used to generate a superior

strategy for new capacity investments and also for identifying good

opportunities for trading capacity with other industry

participants.

The long term effect of

adhering to the competitive based investment strategy was shown to

be significant, clearly outperforming the strategy based on an

application of the discounted cash flow model.

The overall principles

outlined here should apply generally and should therefore be useful

for providing a basis for constructing an investment strategy for

many cyclical industries. Nonetheless, a careful study of the

industry with the purpose of extending and calibrating the model to

a particular situation should be executed. The simulation results

suggest that the return of such a study would justify the

effort.

|