As announced in Newsletter 4, the Investment

Science web site is up. It is located at

http://www.investmentscience.com. There has been a good deal of

activity at the site, and we have plans to add more to it. For one

thing, you will find copies of all past issues of this Newsletter

at the site and some very useful software (see below). Your

comments on the site are welcome.

An Excel add-in for drawing and evaluating

triangular lattices was developed by José Carlos García Franco. We

have used a version of this in the short course and we use it often

to carry out simple analyses of all sorts of investment science

situations, especially those related to real options, and to work

with examples in the text, Investment Science. The newest version

of the software is called LatticeMaker and it is located on the

investment science web site available for (free) downloading.

One of the most interesting

results of real options theory concerns the option to wait. Perhaps

surprisingly, it is sometimes best to delay a project even though

it currently has positive present value.

This phenomenon occurs in

situations of capital investment, switching of operations, and

other long-term projects.

A nice example was pointed

out to me on a recent trip to New York. There are a number of

parking lots in Manhattan on which large income-producing

structures (office buildings for example) could be built. The net

present value of conversion from a parking lot to a building is

positive, and there is no legal restriction against the process;

but the lots are not being converted. It is better to wait until

next year. In fact, next year it will be better to wait another

year. This can go on year after year. This phenomenon has been

studied in the real options literature under certain assumptions

regarding the growth rates of economic variables and the

uncertainty around those rates. However, the advantage of waiting

does not necessarily depend on the presence of uncertainty.

Sometimes it pays to wait even when all future prices are known;

and this can be illustrated with a simple analysis.

To focus our discussion let

us think in terms of the parking lot situation. Suppose that the

annual profit of the parking lot is currently A and that

this grows at a rate  each year. Suppose also that a structure on the site would

produce a rental profit of B and this profit increases at a

rate of

each year. Suppose also that a structure on the site would

produce a rental profit of B and this profit increases at a

rate of  each year.

For simplicity let us assume that conversion can be carried out

immediately at a cost of S but this cost increases at a rate

of

each year.

For simplicity let us assume that conversion can be carried out

immediately at a cost of S but this cost increases at a rate

of  for every year

the project is delayed. Specific values we may wish to try are

A = $1 million, B = $10 million, S= $195

million, and the rates

for every year

the project is delayed. Specific values we may wish to try are

A = $1 million, B = $10 million, S= $195

million, and the rates

where  is the

risk-free rate at which to discount future cash flows.

is the

risk-free rate at which to discount future cash flows.

Note first that if the

parking lot is never converted, it will generate the revenue

stream

The present value of this kind of stream (where

the terms are discounted by

can be evaluated by a standard formula (the

Gordon formula) and its value is

.

For the specific values we

gave, this is  =$22 million. This is the present value if the

parking lot is never converted.

=$22 million. This is the present value if the

parking lot is never converted.

If a structure is

immediately erected on the lot, the revenue stream will

be

and so forth. The value of

this stream is evaluated the same way as the stream from the

parking lot and is

For our specific values this

is  =$25 million. The value gained

by immediate conversion is

=$25 million. The value gained

by immediate conversion is

which for our example is $3

million.

Conversion has a higher

present value than non-conversion. In fact, we see that

so the present value of

conversion is about 13% greater than that of the status quo.

Conventional analysis would dictate that the building should be

converted.

The key mathematics of this

example is simplest if we consider the benefit of waiting one year

to convert. Suppose, for example, that we wait one year instead of

converting at time 0. The difference in present value by

this delay is given by the simple formula

This formula is easy to understand. A delay

will give us A instead of B in the initial period, so

the net change is A - B. However, we also delay the

conversion cost. In discounted terms the cost would have been S but

with the delay it is

The difference is

which we enter as a negative

since it is a cost.

In our example, this

produces  = $8.727 million-a huge difference considering that

the value of converting earlier is only $3 million.

= $8.727 million-a huge difference considering that

the value of converting earlier is only $3 million.

Pursuing this idea we can find the

relatively simple general formula for  the difference between switching at k

and waiting until k + 1. The same logic gives

the difference between switching at k

and waiting until k + 1. The same logic gives

This formula could be used at each time to

determine if it is beneficial to convert or wait. We will come back

to this later, since it helps explain the numerical results we

shall obtain. It is possible to compute the various  defined

as the present value for conversion at time k. They are

given by the (somewhat messy but still manageable) formula

defined

as the present value for conversion at time k. They are

given by the (somewhat messy but still manageable) formula

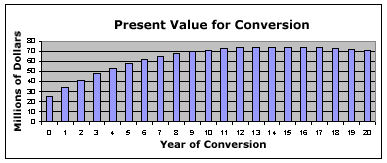

A graph of these values is shown below.

The maximum possible present

value is $73.883 million and is achieved by converting the parking

lot to an income-producing building in year 14.

At year 14, the present

value of going forward with the parking lot (using year 14 as the

starting point) is $43.56 million. The corresponding value for

going forward with the conversion is $240.58 million. Hence,

conversion is carried out when the present value of that project is

5.52 as great as the status quo. At time 0 we found that

conversion was worth 13% more than the status quo; that was not

nearly enough; we need a ratio of 5.52 to justify immediate

conversion.

The reason that one should

wait to convert is that waiting postpones cost, and since in our

example  = 0, this postponement is valuable because of

discounting. This savings initially outweighs the increased cash

flow due to the structure. However, as time k increases, the

rent increases and the cost advantage to delay becomes small

compared to the difference in profit. This is clearly shown in the

equation for

= 0, this postponement is valuable because of

discounting. This savings initially outweighs the increased cash

flow due to the structure. However, as time k increases, the

rent increases and the cost advantage to delay becomes small

compared to the difference in profit. This is clearly shown in the

equation for  which shows that the term

involving B will for large k cause

which shows that the term

involving B will for large k cause  to become negative.

to become negative.

It is fun to consider the

case where  . Then if it is

advantageous to wait at time 0 it is advantageous to wait

every year---forever.

. Then if it is

advantageous to wait at time 0 it is advantageous to wait

every year---forever.

The conclusions of this

example are of course dependent of the values of the parameters.

And the advantage of waiting rapidly disappears if the total number

of years considered is not infinity. Hence, projects in fast-moving

industries may have short lives and should not be delayed.

Competition is another factor that may tend to favor immediate

action rather than delay.

The whole issue is more complex if there is

uncertainty with respect to, say, the profits. In this case there

may be an advantage to waiting, simply to see what these profits

will be. This, however, is another story. The main point of the

example presented here is that it may be valuable to wait even if

the present value of current action is positive.